Syntax

The Average Directional Movement is implemented as a composite function. It uses the Directional Movement Index function and the Modified Moving Average. The expression is:

MMA(DMI(close; high; low))

Arguments

The result of the DMI function is used as an argument for the MMA function. The arguments of the DMI are described in the "Directional Movement Index" topic.

Result

The result is an array.

Description

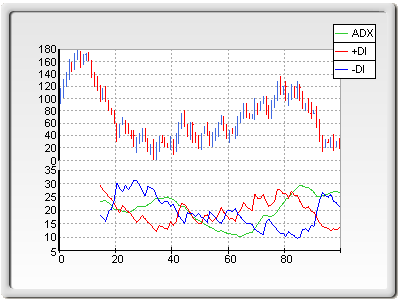

The Average Directional Movement is a part of the Directional Movement System developed by J. Welles Wilder. The system consists of three lines:

-

The Positive Direction Indicator (+DI) summarizes upward trend movement;

-

The Negative Direction Indicator (-DI) summarizes downward trend movement;

-

The Average Directional Movement Index (Average Directional Movement) indicates whether the market is trending or ranging.

Declining Average Directional Movement shows that the market is losing direction. When Average Directional Movement falls below both +DI and -DI, it signals a lifeless market. When Average Directional Movement rises above both +DI and -DI, it signals that the market is becoming overheated. The Average Directional Movement is defined as a moving average of the Directional Movement Index. By default, the Modified Moving Average is used for smoothing with a period of 14 days. You can use another type of moving average by changing the original formula. For more information about the DMI and the MMA functions, see the "Directional Movement Index" and the "Modified Moving Average" topics.

Related Examples

Windows Forms: Examples\Chart\VB\PresentationGroups\Function\Functions1